(803) 919-2489

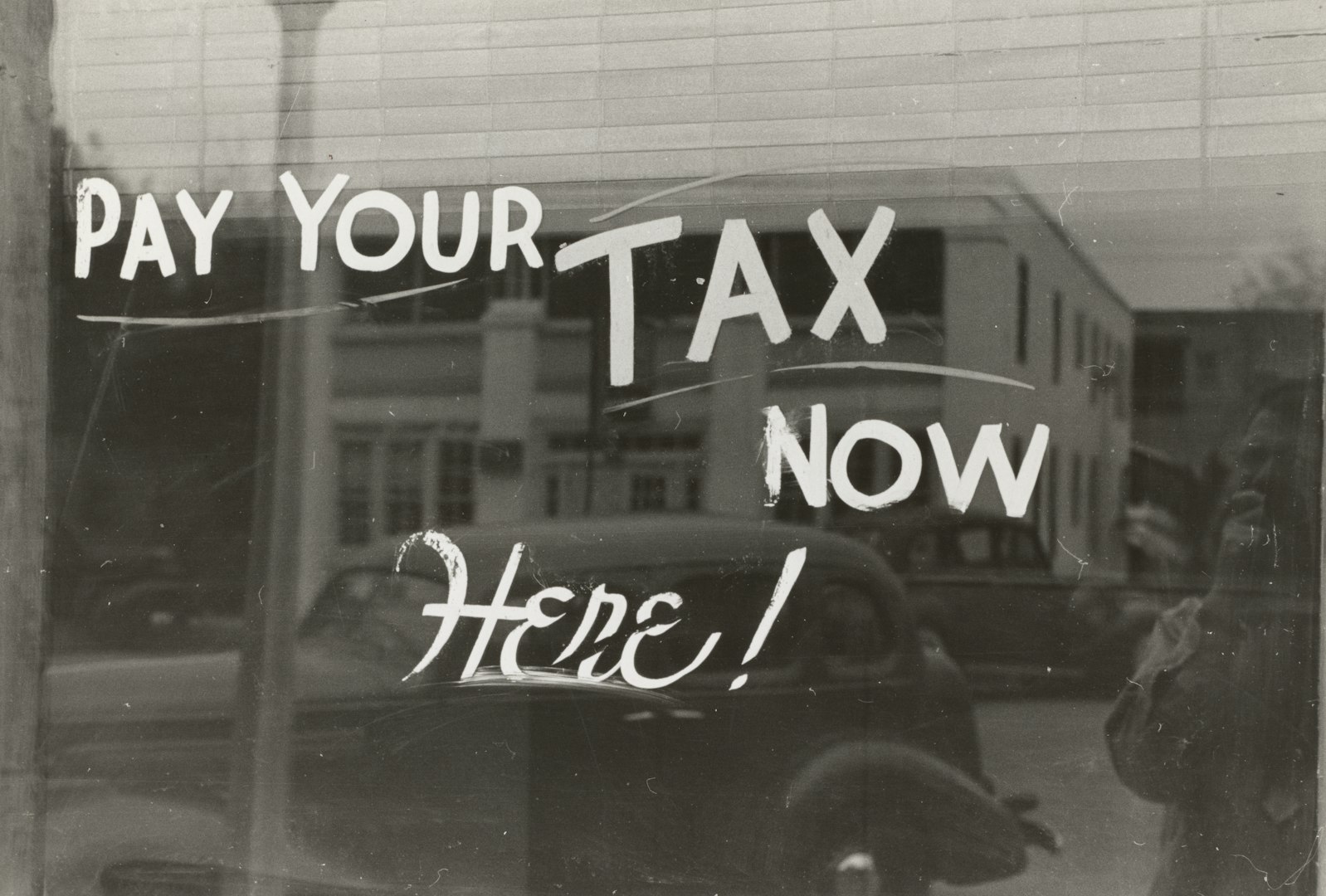

Cheat Uncle Same: Tax Tricks For Landowners

Avoid and Defer Taxes on Land Sales with Seller Financing and 1031 Exchanges

WY Land Exchange

"In this world, nothing can be said to be certain, except death and taxes" - Benjamin Franklin

Ben Franklin wrote these immortal words in a 1789 letter to his friend Jean-Baptiste Le Roy with regards to the permeance of the new United States constitution. Almost 250 years later, this quip largely remains true: death remains inevitable and Uncle Sam's reach has become global, making taxes truly unavoidable. Or are they? In this blog post, I'll be exploring the powerful tools available to land owners to do just that: avoid taxes and "cheat" Uncle Sam (there is still no way to cheat death).

A quick disclaimer: This article IS NOT financial advice. This is a general discussion of the various techniques land owners may utilize to avoid taxes. While these are well established techniques, always consult your lawyer and accountant before engaging in any tax mitigation or avoidance strategy. Your situation is unique and not all strategies may be appropriate for your needs. Again, this is not financial advice.

Seller Financing

Land owners have often used seller financing to accomplish a variety of goals with regards to their properties. Typically, banks don't lend on land unless there are plans to develop it. More often than not, someone purchasing land for the value of that land itself, rather than to develop it has to pay cash or get more creative.

This is where seller financing comes in. For the buyer, seller financing takes the place of a bank loan: in exchange for a (typically high) interest rate, they get the ability to buy property they are unable to pay for in cash and can't get a loan for.

For the seller though, this can be a very powerful tool when done correctly. For one, it opens up a larger pool of potential buyers (i.e. people who do not have enough cash to purchase the property outright). Second, so long as the property owner was a long-term investor and isn't classified as a dealer by the IRS, seller financing can defer taxes on the property and provide the seller with a steady stream of passive interest income.

The payments made on the property under a seller financing arrangement are typically taxed under the IRS's installment sale rules. Under these rules, the seller recognizes a gain only when each installment is paid, and only proportional to each installment. The seller would also pay taxes on the interest earned on the note at the ordinary income rate. If a property were depreciated, you could also have to claim depreciation recapture, however, since land cannot be depreciated, this is not typically a concern for landowners.

To give an example of how this would work, suppose you sold your 10 acre property for $200,000 and you bought it several years ago for $100,000. If you sold for cash, you could be on the hook for $20,000 in capital gains in the year you sold it. Ouch! In fact, even if this was your only income for the year and you were married, you could be looking at a 15% tax - or $15,000.

Now let's say that you sold on seller financing where the buyer put 50% down and you earned 10% interest and amortized the note over 10 years. In this year, you would be paid $100,000 for the property and only recognize $50,000 in capital gains plus the gains on the $6,134 in principal payments ($3,067 in gains) and the $9,723.90 in interest payments. Depending on your other income, this could be the difference between owing $15,000 in capital gains taxes in the year of the sale or owing just the taxes on your interest payments. Further, in subsequent years, the principal payments would be tax free if your total income is below $96,701.

In other words, in this scenario, you could save thousands, if not tens of thousands in taxes on the sale of your property and in place of endless property taxes, you would get a steady stream of income for the next 10 years. There are some risks and potential drawbacks to this strategy. Of course, the buyer could default on their payments. Alternatively, the buyer could prepay the note, putting you on the hook for the remaining taxes in one year and taking away your income stream. The risk of default could be mitigated through a well-designed contract, conducting a credit check on your buyer, and by requiring a sizable down payment. Prepayment risk can also be mitigated by adding prepayment penalties into the note.

Overall, seller financing is potentially a great strategy given the right buyer and the right circumstances, providing the seller with passive, tax-deferred income for years to come. But as great as this strategy is, there is another, more powerful strategy, that could allow you to NEVER pay capital gains taxes during your life.

The 1031 Like-Kind Exchange

What if I told you that the government has a provision in the tax code that will allow you to legally avoid paying all taxes on the sale of your vacant land? Sounds too good to be true? Well, it isn't! The 1031 like-kind exchange has been a feature of the tax code for decades. Essentially, it allows property owners to sell their appreciated real estate and reinvest the proceeds into another property tax-free, subject to depreciation recapture.

To conduct a 1031 exchange, the seller must adhere to a specific process. First, the proceeds of the sale must be deposited with a qualified intermediary (generally must trust companies and banks will offer this service) immediately upon the sale of the original property. Second, within 45 days of the sale, the seller must identify the replacement property in writing to the intermediary. The seller may identify up to 3 properties of any value or as many properties as they want subject to a valuation test. Third, once the replacement property(ies) are identified, the seller must close on the purchase of the new properties within 180 days of the close of the original sale. It is also possible to do this in reverse, whereby you purchase a property and then within 45 days identify a property to sell and close on the sale within 180 days of the purchase.

If this is done correctly, the seller could, in theory, never pay taxes on the capital gains? How does this work? Let's say you sell the same piece of land as before for $200,000 with $100,000 in gains but instead deposit the sale proceeds with a qualified intermediary because you plan to do a 1031 exchange. You then go out and, within 45 days identify an apartment building generating $8,000 in rental income per month for $800,000. You then purchase this property with a $200,000 down payment within 180 days. Congratulations! You now have an income producing property and have avoided all capital gains on the sale of your land. In theory, you can do this as many times as you want until you die, rolling that original cost into each new property you buy. And the kicker? When you die, the property gets a step-up in cost basis so your heirs can sell it with no capital gains taxes!

If you're thinking this sounds too good to be true, then you're (kind of) right. There are a number of limitations to this strategy. Firstly, you could be subject to depreciation recapture depending on the property type. In land, this generally isn't an issue - but for other properties like apartments or retail centers, this could be a problem. Second, the new property must be in the US to be considered "like-kind" (generally not a huge problem for American investors). Third, real property must be exchanged for real property, not stocks, bonds, mutual funds, ETFs, cryptocurrency, or collectibles. This rule isn't as restrictive as it sounds because real property could be anything from an apartment building, to water rights, to Delaware Statutory Trusts, but it is important to understand this catch. Finally, the property must have been held for business or long-term investment purposes.

What this last point means is up for interpretation but generally if you've held the property for a number of years (again, consult your attorney and your accountant - this is not financial or tax advice) and you did not buy it with the intent to sell it for a quick profit, you will generally be eligible for a 1031 exchange.

This strategy is also not without its risks. For example, if you fail to identify and close on a property in the timelines laid out by the IRS, you would be on the hook for all of the taxes. Further, since your funds are going into the account of a Qualified Intermediary, there is a degree of trust required to execute this strategy. Finally, if the funds do not go straight from the escrow to the qualified intermediary, you would be ineligible for a 1031 exchange and owe taxes on the property. These risks can be mitigated however. Firstly, only working with qualified intermediaries at major banks or trust companies and requiring your signature for funds to be disbursed from the account largely mitigates the risk that your funds could be misappropriated. Second, if you intend to conduct a 1031 exchange, you should let the qualified intermediary know well in advance of the sale closing. Finally, and perhaps most critically, you can mitigate the risk of not having a replacement property by beginning to look the moment you decide to sell the original property.

All that said, the rules for 1031 exchanges are extremely generous and open up a world of possibilities. One potential permutation of the 1031 example I gave before actually results in you being able to take out a portion of the sales proceeds tax free. Let's say instead of an $800,000 apartment building, you purchased a rental home for cash with the $200,000 of 1031 proceeds. The next day, you go to a bank and take out a $150,000 mortgage on the home. This would not, under the current rules, qualify as a taxable event, since you followed the rules of the 1031 exchange and reinvested the proceeds. The debt you've taken out is not the same under current tax law as selling the property, so you've pulled your money out totally tax-free and now you have an asset that's paying you a stream of income you didn't have before! (Again, this is not financial advice, consult your attorney and accountant).

Conclusion

I once quipped to a friend that real estate is essentially a cheat code to generational wealth. The opportunities our government has given real estate investors to avoid taxation are truly unmatched by any other industry. I'm sure there are even additional strategies that I've never heard of and that allow for even more flexibility than the ones I've discussed. So many land owners have no idea that these techniques exist and are leaving thousands of dollars in value on the table when they go to sell their land.

Whether you're looking to defer taxes by selling your land on an installment or with a 1031 exchange, we want to work with you! While we can't advise you on the deal or the particulars, we can certainly help you identify professionals who will be able to guide you to a solution that best meets your needs and we will be happy to structure the deal so that it fits your needs. If you're ready to sell your land, give us a call or fill out our form to get in touch with us today - we would love to help you explore these strategies!

As always, thank you for reading and I look forward to having you join us for my next post!